Knowledge Compounding: Why it is better to be foolish at the start than at the finish

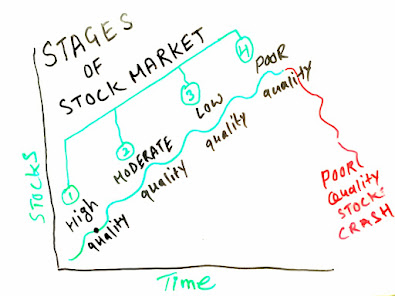

We are probably at the fourth stage of the market where being in the quality stocks is curse, they are no longer producing returns because they are fully discovered. Investors are now bidding for low quality, unloved, undiscovered stocks.

This marks the phase of the market where investors begin to compromise on quality and the fundamental principles of investing in favor of chasing the next big stock.

They start disregarding quality in pursuit of higher returns. This herd mentality leads to a strong bullish phase in low-quality stocks. Novice investors, or so-called alpha-riders, become the new authorities in the market.

This reminds me about the wisdom that Vijay Kedia shared with us few years back, “In good times everything looks rosy particularly for the first-time investors who have not seen the market cycles and hence beat the drums. Bull markets produce many self-claimed genius or stock pickers but in reality, the real stock market genius are bornin the bear market because that is the time you learn the most from your mistakes and introspect what you are doing”

The old guard who still values quality, prudence, and investing wisdom is considered out of touch, obsolete, and irrelevant. It's a challenging time when wisdom and prudence are scorned and looked down upon. People start to ridicule these principles.

But let's not forget what Warren Buffett said, "What the wise do in the beginning, fools do in the end."

Happy Compounding

Jitendra

Caution: These are my personal views and shared only for the education and knowledge purpose.

Comments